I have search the internet for the best and most effective ways to make money online just click on the link on the bottom of this site and start making money!!!!

Thursday, November 27, 2014

Tuesday, November 25, 2014

Still Looking for Gold's Big Low

GOLD's reversal from $1130 to $1200 combined with sharp rebounds in the gold miner stocks has given precious metals bulls some hope that the bottom may be in, writes Jordan Roy-Byrne at TheDailyGold.

A few weeks ago we noted that the sector was extremely oversold and a snapback rally could begin. Gold has been the tell for the bear market and a real bull market throughout the precious metals complex may not begin until gold's bear has ended. In this editorial we dig deeper into some things to watch as they pertain to gold.

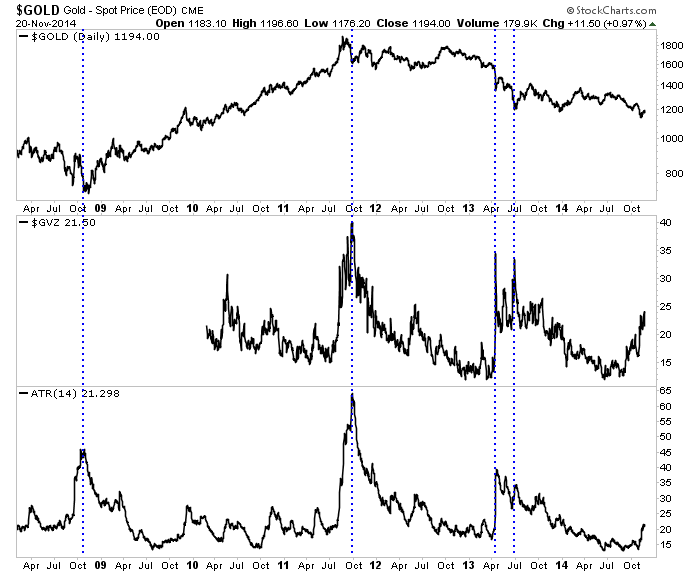

First, a focus on gold's volatility. The chart below shows gold and two volatility indicators: the CBOE volatility index and average true range.

Peaks in daily volatility have coincided with important peaks and troughs in the gold price. Volatility declined from summer 2013 through summer 2014 before perking up as gold declined from $1255 to $1130. Yet both volatility indicators are not close to extremes.

Volatility does not necessarily need to reach an extreme to signal a bottom. However, the two biggest volatility spikes were at the 2008 bottom and 2011 peak. A sharp decline in gold below $1100 towards major support, combined with a spike in volatility, could signal a major turning point.

I'm also focusing on the Commitment of Traders report on gold futures positioning. It's an excellent sentiment indicator. By some metrics (objective and anecdotal) gold's bear market has reached extreme territory. However, the COT is presently not at an extreme.

As a percentage of all open contracts, we plot the speculative traders' position twice – first their gross short position (bearish) and their net position (bullish minus bearish contracts). If these readings can exceed the 2013 extremes then they would be at 13-year extremes. A spike in the gross short position, while negative in the short-term, provides future fuel (short covering) for a very strong rebound off the bottom.

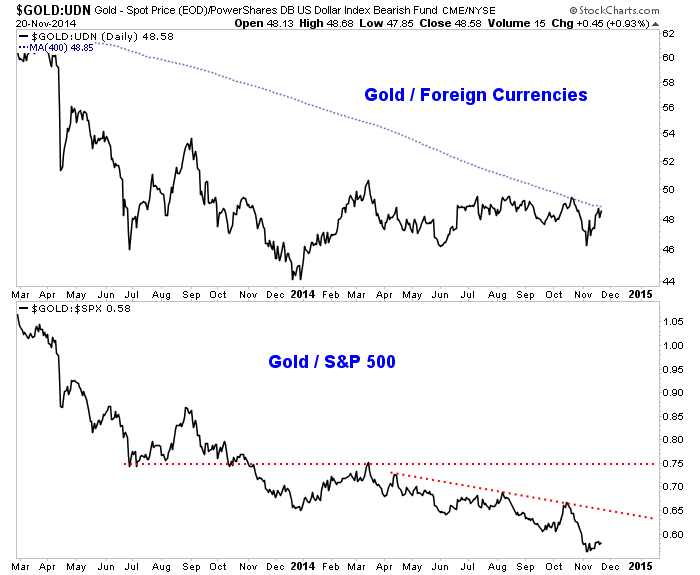

Meanwhile, let's not forget gold's relative strength against other asset classes. We've noted before how gold's relative strength tends to perk up before the gold price itself bottoms. The chart below plots gold against a foreign currency basket (the inverse of the US Dollar index) and gold against the S&P500 equity index.

Gold is holding up well against foreign currencies but is coming to an inflection point. I don't think its going to breakout yet but I could be wrong. Meanwhile, gold continues to be very weak against the stock market.

Gold has been the tell for the bear market and my work leads me to believe the bottom is ahead and not behind us. Last week we noted the likelihood of a test of major support near $1000 per ounce rather than a bottom at an arbitrary level. In addition, gold has yet to have a volatility spike on par with the spikes at the 2008 bottom and 2011 top. Moreover, current positioning in the futures market remains below the extremes seen in 2013. Finally, gold has more work to do on the relative strength front before it can sustain a recovery.

All this being said, it is important to keep an open mind to various possibilities. Silver and the mining stocks are totally bombed out and we should pay close attention if they retest their lows. The weeks and months ahead figure to be enticing and exciting for precious metals traders and investors. Expect quite a bit of day to day volatility as we see forced liquidation and occasional short covering. Be patient but be disciplined. As winter beckons we could be looking at a lifetime buying opportunity.

Buy gold at the lowest prices in the safest vaults today...

original copy click here >>https://www.bullionvault.com/gold-news/gold-bottom-112420141

PS > IF YOURE LOOKING FOR THE BEST WAY TO BUY GOLD WITHOUT BREAKING YOURE POCKET BUY IT BY THE GRAM AND GET PAID TO REFER OTHERS TO DO THE SAME CLICK HERE AND I WILL SHOW YOU HOW IM MAKING A RESIDUAL PASSIVE MONTHLY INCOME WHILE SECURING MY FINACIAL FUTURE WITH GOLD

www.sharingthewealth22.net

original copy click here >>https://www.bullionvault.com/gold-news/gold-bottom-112420141

PS > IF YOURE LOOKING FOR THE BEST WAY TO BUY GOLD WITHOUT BREAKING YOURE POCKET BUY IT BY THE GRAM AND GET PAID TO REFER OTHERS TO DO THE SAME CLICK HERE AND I WILL SHOW YOU HOW IM MAKING A RESIDUAL PASSIVE MONTHLY INCOME WHILE SECURING MY FINACIAL FUTURE WITH GOLD

www.sharingthewealth22.net

Labels:

Cambridge,

currency,

decline,

dollar,

Gold,

Karatbars,

peaks,

precious metals,

spike,

stockmarket,

Volatility,

workfromhome

Monday, November 24, 2014

Pope to take on hot EU topics in Strasbourg visit

Pope to take on hot EU topics in Strasbourg visit

STRASBOURG, France (AP) — Pope Francis will deliver his first public speech about Europe on Tuesday, likely to focus on complex continental issues such as high jobless rates among the young, and immigration.

The pontiff's whirlwind, four-hour visit to the European Parliament and the Council of Europe, Europe's main human rights body, in Strasbourg is shaping up as more of a secular stop than a liturgical layover.

Aides say Francis will address topics including unemployment and immigration — two hot-button issues in Europe. His address is also likely to revive themes that he evoked during a private meeting with a group of European bishops last month.

Straying from his prepared remarks at that time, the pope said that Europe was "wounded," alluding to soaring jobless rates — especially among the young — in places like Spain and Italy, according to a transcript of the speech reported by noted Vatican commentator Sandro Magister on Monday.

"It has gone from the time of prosperity, of great well-being, to a worrying crisis in which young people too are discarded," Francis reportedly said.

Francis' trip has disgruntled some. Some local religious leaders regret that he won't visit Strasbourg's famed cathedral. Some left-leaning lawmakers argue he has no place visiting secular European institutions. The activist group Femen staged a brief demonstration at the cathedral on Monday, with one woman draping herself in the European flag at the altar.

French Catholic leaders were planning to broadcast the pope's remarks to the European bodies on a big screen in the cathedral on Tuesday.

Francis' trip is the first by a pope to Strasbourg since John Paul II visited in 1988. That was a very different Europe — before the Berlin Wall came down.

PS> IF YOU'RE TIRED LIKE ME OF JOBLESS AND UNEMPLOYMENT NEWS HERES THE SOLUTION CLICK HERE AND LEARN HOW MY LIFE HAS CHANGED SINCE I STARTED KARATBARS >>> WWW.SHARINGTHEWEALTH22.NET

Labels:

Europe,

Francis,

Pope,

Pope Francis,

speech,

Strasbourg

Advantages of owning Karatbars Gold

Karatbars Advantages

1- Karatbars International was founded in 2011 ,now in their 4th year, open in 122 countries and growing-timing is perfect!

2-Karatbars gold is produced by an LBMA(London bullion market Association) accredited refinery. Certified for purity and weight !

3-Highest quality 999.9 gold currency bullion-Peace of mind knowing you own the very best Gold !

4- Karatbars great affiliate compensation plan allows you to earn a residual passive income

refer others who purchased gold and you can earn commissions create your future by helping others succeed and earn free gold !

5-Commissions paid weekly to your personal Karatbars International Mastercard - No waiting for monthly checks in the mail, its automatic each week !!

6-You decide how much gold you want and when you want it - You're in control , no minimum requirement!!

7-Choose free gold storage at a High Security and Bonded Prosegur or have it shipped directly to you - Rest easy knowing your gold is safe and secure until you want it shipped directly to you !

8- A variety of collector Karatbars cards available, including a Vatican approved card with Pope John Paul ll-Karatbars make great gifts from birthday day cards to anniversaries cards

9- Purchased gold at your own rate and build your business at your own pace ! You decide whats best for you !

10- No Enrollment fee - to be a customer Unlike so many other companies ,with Karatbars there is no cost to become a member !

Building Wealth with Gold ! you decide ...

for those who want to be on the fast track , Karatbars has designed a 12 week plan

for those who want to go at their own pace , Karatbars has a 12 Duplication plan dont waste anymore time to get started go to my website at www.sharingthewealth22.net and get more info and get starded today !

Sunday, November 23, 2014

Top 10 reasons to Own Gold

Top 10 reasons to Own Gold

1) Gold is universal money, a tangible store of value and wealth protection.

2) Physical gold cannot go bankrupt or broke. Gold bullion will never default on promises or obligations.

3) In times of crisis, gold bullion Tends To Increase Sharply In Value.

4) Gold is not created by governments nor is its value dependent upon governments. All of today's governments issue paper fiat currencies ( dollars, euros, yen, pounds, yuan, rupees, pesos, etc. ). Fiat currencies have no tangible value and are backed only by government decree ( namely legal tender laws ). Historically, governments always create and issue too much fiat currency. Over the longterm, paper fiat currencies are worth less and less, until they are ultimately worthless.

The Average Lifespan Of A Fiat Currency Is 27 Years!

The Average Lifespan Of A Fiat Currency Is 27 Years!

5) Individuals Buy And Own Physical Gold privately and anonymously.

6) Super-national and national bank regulatory agencies are making moves to Reclassify Gold As Zero Percent Risk-Weighted Asset helping to further drive physical demand from smaller banks.

7) Today, most nations are inflating and devaluing their respective fiat currency's purchasing power to both boost international trade and exports, and to more easily finance their nominal debts and social program liabilities. For instance, in the USA, retirees will most likely receive future promised Social Security checks... although there is no promise on how many goods and or services these checks will actually buy.

8) Gold bullion investments are extremely portable, liquid, and Easy To Store In One's Home.

9) Governments And Central Banks Are Now Net Buyers Of Gold, meaning they are buying and hoarding more gold bullion than they are selling.

10) Politically or through market demand, governments will come under increasing pressure in returning to currencies backed by gold. Returning To A Monetary System Anchored In Gold could cause the value of gold bullion to rise considerably in the months and years ahead.

Labels:

affiliate,

biz op,

currency,

dollar,

Gold,

inflation,

Karatbars,

start up,

stockmarket,

workfromhome

Subscribe to:

Posts (Atom)